How Buy Now Pay Later (BNPL) works

- Kian Jackson

- Apr 26, 2021

- 1 min read

As a BNPL customer, the experience is seamless and very easy to follow. But in the background, things can become complex very quickly.

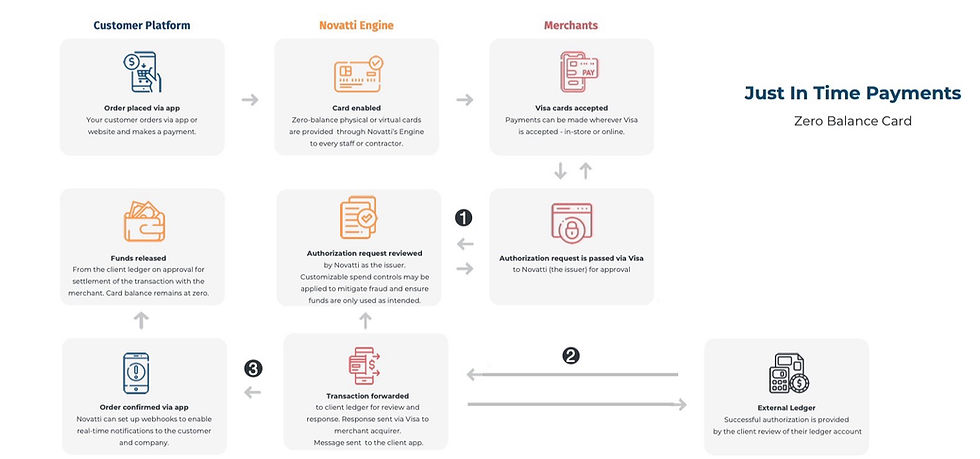

This form of payment method is called "Just in time payments". This process uses a prepaid card to fund an account in real-time during the transaction process automatically.

Prepaid cards have traditionally been used to boost customer loyalty and replace cash for travellers. They offer the same payment experience as debit or credit but without the friction of setting up an account at a finial institution. In this case, a virtual prepaid card becomes an innovative cog in the wheel so payment can be made.

In the original model, funds need to be allocated to individual accounts and balances maintained to support every cardholder transaction. In this case, money is moved from an allocated funding account into the cardholder account to support the transaction. This will be an automated solution based on business rules configured on the platform and will support both face to face transactions and online.

Below is the overall workflow from where an order is placed on the BNPL platform all the way through to the order confirmed back to the customer. This is an example that works on the Novatti (NOV:ASX) platform.

Comments